How to Get a Spanish NIE Number?

Spanish NIE Number is essential for a wide range of legal purposes and official jobs, whether you are resident or non-resident in Spain. If you want to purchase or rent a house, work and many other purposes, you will need an NIE number. Read this article to learn how to get a Spanish NIE number?

⚠️Preliminary Note: We only help people get NIE’s to sign property deeds and buy properties in Spain. We are not qualified to assist with NIE’s for other purposes. Moreover, this article is for informational purposes only.

Spanish NIE Number defined and basic requirements

The Spanish NIE number is a Spanish tax identification number for foreigners. NIE stands for “Número de Identificación de Extranjeros”. Both residents and non-residents must have this document. Please read our article NIE number in Spain for more information.

You can apply at the Spanish Embassy in your resident country, but you must be legally in Spain to receive the document.

Two Types of Spanish NIE Number: Resident and Non-Resident

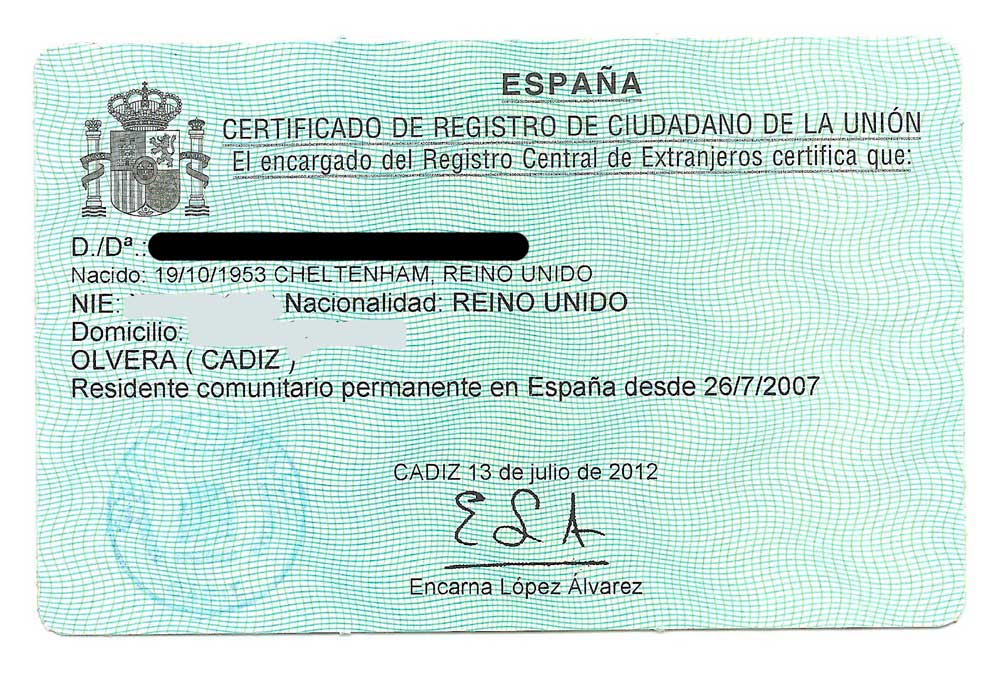

- Resident NIE. Only citizens of the European Union (EU), Switzerland, Iceland or Norway can apply for it. The applicant will become a resident of Spain (see below for a definition). As a resident, you must report and pay annual income taxes in Spain on your worldwide income. Thus, please don’t apply until you speak with a Spanish tax attorney. We can refer to one. This NIE is on a green paper card entitled ‘Certificate of Residence’.

- Non-Resident NIE. It’s for all non-EU citizens and EU-citizens who do not want to be a Spanish resident. It only allows you to do certain acts in Spain, such as buying a property. It does not allow you to live or work in Spain. To live and work in Spain, non-EU citizens must go through the immigration process. With this NIE you are not a Spanish resident, thus you do not have to report and pay annual income taxes in Spain.

Where Do I Get a Spanish NIE Number?

1) Resident NIE. You apply at the local police station (comisaria) where you live. In Barcelona, it’s on Rambla Guipúzcoa.

💡#ProTip You must get an appointment online (cita previa). It would be best to try at 8:00 am on a Monday, or you could also hire someone to get it for you. They’re hard to get. It might be easier to apply at the Spanish embassy or consulate in your resident country.

2) Non-Resident NIE. In Barcelona, you apply at the comisaria on Passeig de Sant Joan. You need a “cita previa” as described above. And you can also apply at the Spanish consulate in your resident country.

What Documents do I Need to get a NIE?

Resident NIE.

You’ll be living in Spain, so it’s a long list. Here are the requirements to get a Resident Spanish NIE Number:

- Form EX15 (the application)

- Appointment confirmation

- Your original passport plus a copy of the photo page

- A recently dated, signed and stamped bank statement in your name only that shows you have at least 6.778€ in the bank. This figure as of 2021; it’s subject to change. If you have dependents the amount is higher. A local bank is recommended.

- Health Insurance. The policy must include ambulance, hospital and have no co-pay. You’ll need the full original policy, dated, signed and stamped by the insurance company. A local company is recommended. USA policies are almost always rejected. If you have a job, ask your employer if you have a work contract and if you’re enrolled in Spain’s public health system. If so, you won’t need to show insurance.

- Resident Registration (Empadronamiento Certificate). Go to the city government (Ayuntamiento) in the neighborhood. You have to prove your address so bring a signed rental agreement (lease) with a duration of at least 6 months and proof that you’re paying rent; or your property deed. Ayuntamiento will check to confirm the owner so their name must be on the lease. If you don’t have a lease or deed, go to Ayuntamiento and ask.

Non-Resident NIE.

Compared to Resident NIE, it’s a shorter list because you don’t live in Spain. Let’s have a closer look at the requirements:

- Form EX15 (application)

- Appointment confirmation, or if you don’t have one, a letter from a Notary Public explaining why it’s an emergency.

- Your original passport plus a copy of the photo page.

- A letter explaining why you need the NIE (Carta de Motivo). You should get this from a Spanish Notary and it should set forth the reason why you need the NIE: to buy property, accept employment, etc.

- No need to show money in the bank or health insurance because you will not be living in Spain.

How much does it cost to get a Spanish NIE Number?

NIE Spain tax fee is around 11 euros. The application form is written in detail, including how and where you must pay this fee.

Before you Apply for an NIE number in Spain

Taxes. You must file an annual tax return in Spain with a resident NIE reporting your worldwide income. If you file and pay in your native country, you might get a tax credit. Be advised, tax questions are very tricky and require expert advice. Before you, or your spouse, apply for a resident NIE, consult with a Spanish tax attorney (abogado fiscal). I can refer to one.

No Taxes. With a non-resident NIE, you don’t have to file a tax return in Spain. However, you are not legal to live or work here either. Generally, non-residents can only live in Spain for 90 days or 180 days in 365 days.

What is considered a Spanish Resident?

- You live in Spain for 183 days or more per year

- You live in Spain for less than 183 days but you don’t have a home elsewhere so your principal residence is in Spain

- Your central economic activity’ is in Spain or it’s where you earn most of your money

- Your spouse or a child live in Spain. Then a presumption arises that you live in Spain too. You can rebut this with evidence that you live somewhere else, but it’s hard to overcome the presumption. This issue comes up a lot and the foreigner normally loses.

Questions or Comments? Please let me know. Mark at info@spainadvisors.com or visit the Contact page.

Deja una respuesta

Lo siento, debes estar conectado para publicar un comentario.